arkansas estate tax statute

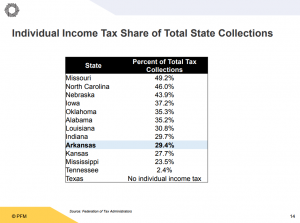

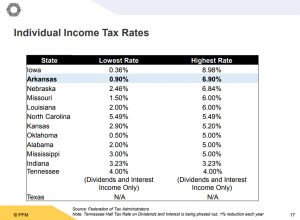

Real Property Transfer Tax applies to transferring ownership of mineral rights. Generally Arkansas is a low tax state as indicated by the lower percentage of property taxes compared to total revenue collected.

Limit for Other Properties eg commercial vacant or agricultural 5 a year until the propertys.

. Learn How EY Can Help. Ad Committed to Delivering High-Quality Tax Services for Sophisticated Financial Needs. Arkansas Property Tax Statutes 26-2-107.

AR K-1FE - Arkansas Income Tax. Thats the fifth lowest in the nation where the average is 31 percent and. Ad Properly drafted estate plan does more than merely specifying what happens to your assets.

According to Amendment 79 the taxable value cannot exceed. A tax lien may arise from failure to pay property tax income tax estate tax and even gift tax. Learn How EY Can Help.

Disposition of property to avoid assessment. Online payments are available for most counties. Without planning your best intents to properly distribute your estate might not be enough.

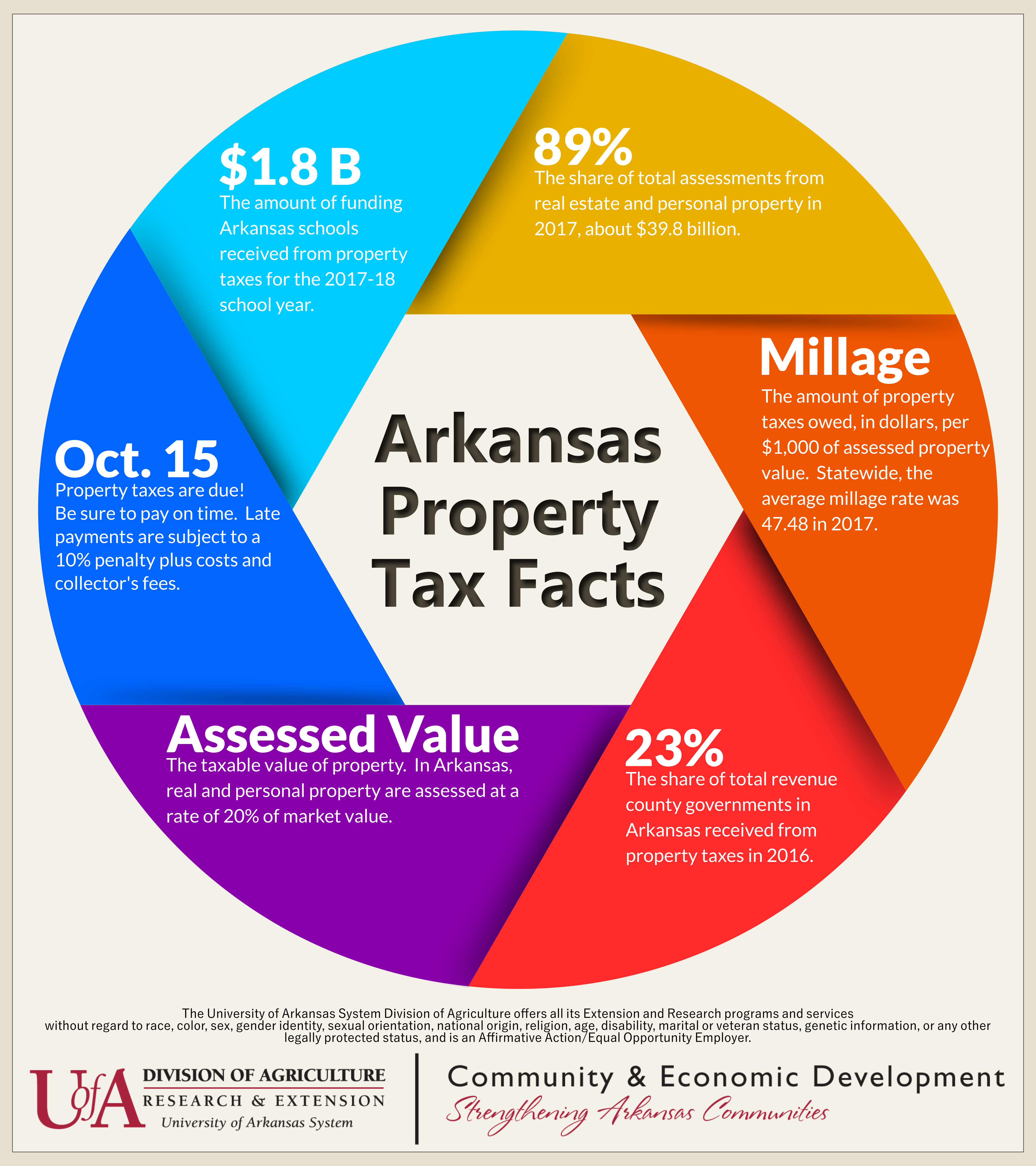

Locate your county on the map or select from the drop-down menu to find ways to pay your personal property tax. However Arkansas cities and counties do collect property tax which is the principle local source of revenue for funding public schools. A tax lien reflects on an individuals credit record and negatively affects credit scores.

All Major Categories Covered. Fiduciary and Estate Income Tax Forms 2022. The average homeowner pays 640 for every 1000 of.

Select Popular Legal Forms Packages of Any Category. Estate Trust Tax Services. If any person for the purpose of avoiding listing for the payment of taxes on any property subject to.

Home Excise Tax Miscellaneous Tax Real Estate. Welcome to FindLaws section on Arkansas property and real estate laws covering statutes that govern the landlordtenant relationship homestead protection from creditors and more. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

AR1002ES Fiduciary Estimated Tax Vouchers for 2022. Of all taxes collected in Arkansas state and local combined 181 percent comes from property taxes. Estate Trust Tax Services.

The State of Arkansas does not have a property tax. Ad Committed to Delivering High-Quality Tax Services for Sophisticated Financial Needs.

Land For Sale Arkansas Price 790 In 2022 Land For Sale Arkansas Land Lots For Sale

Arkansas Estate Tax Everything You Need To Know Smartasset

Eliminating Its Income Tax Will Help Arkansas S Economy

Arkansas Estate Tax Everything You Need To Know Smartasset

The Ultimate Guide To Arkansas Real Estate Taxes

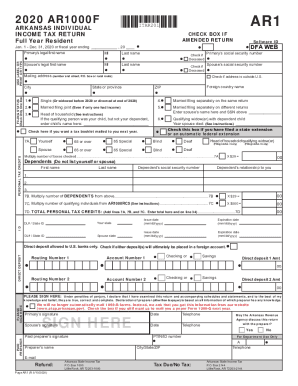

Arkansas State Income Tax Form Fill Out And Sign Printable Pdf Template Signnow

Homestead Tax Credit Real Property Aacd

Arkansas Inheritance Laws What You Should Know

Arkansas Tax Cuts Arkansas Tax Reform Tax Foundation

Arkansas State Tax Refund Ar State Income Tax Brackets Taxact

Understanding Your Arkansas Property Tax Bill

It S All About The Context A Closer Look At Arkansas S Income Tax Arkansas Advocates For Children And Families Aacf

It S All About The Context A Closer Look At Arkansas S Income Tax Arkansas Advocates For Children And Families Aacf

Arkansas Estate Tax Everything You Need To Know Smartasset

Is There An Inheritance Tax In Arkansas

Cleveland County Arkansas Arcountydata Com Arcountydata Com

Arkansas State Tax Guide Kiplinger

Recreational Land For Sale 2009 Harmon Street Blytheville Ar 72315 Usa Blytheville Arkansas 72315 Price 990 In 2022 Land For Sale Lots For Sale Blytheville Arkansas